Free Classifieds at INNetAds.com - View Item Content by ID 2921629

INNetAds > Real Estate > Other Real Estate Ads > Item ID 2921629

Item ID 2921629 in Category: Real Estate - Other Real Estate Ads

Cannot view this item. It could be pending, expired or deleted.

Below item is randomly selected from the same category and may have similar content.

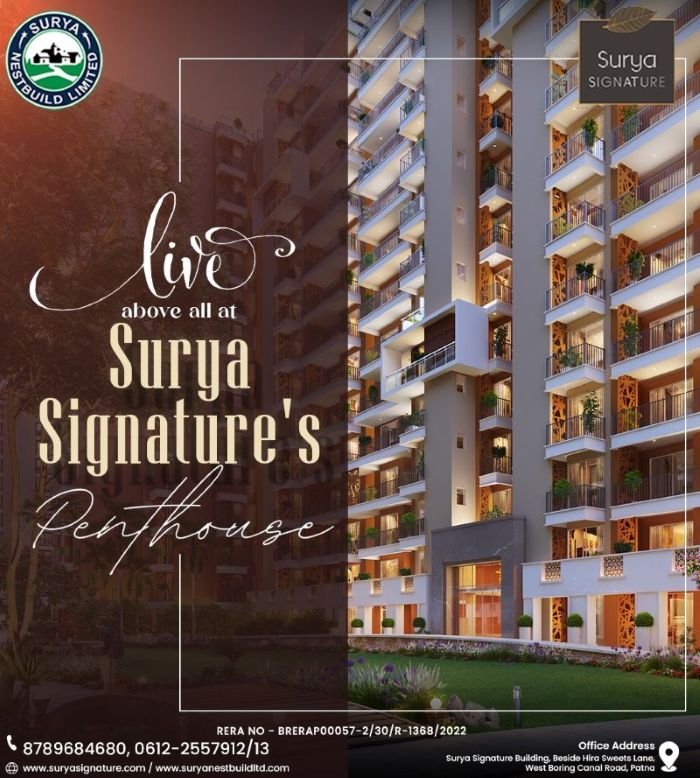

Looking for a trusted Real Estate Developer in Danapur, Patna? | |

Looking for a premium 3-4 BHK flat in Danapur? You can explore Surya Signature brought to you by a trusted real estate developer in Danapur, Patna. This project offers well-planned flats in a gated society suitable for families. The location gives you easy access to schools, markets and daily needs. Surya Signature focuses on quality space and smart design so you can enjoy a better lifestyle. If you want a home with comfort plus convenience, Surya Signature can be the right choice for you.  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: Bihar Target City : Patna, India Last Update : 18 November 2025 1:55 PM Number of Views: 83 | Item Owner : Surya Signature Contact Email: Contact Phone: 8789684680 |

| Friendly reminder: Click here to read some tips. | |

INNetAds > Real Estate > Other Real Estate Ads > Item ID 2921629

© 2025 INNetAds.com

USNetAds.com | GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | CNNetAds.com | Hot-Web-Ads.com | USAOnlineClassifieds.com

2025-11-27 (0.685 sec)